Corona Monthly Housing Report (May 2017)

| Corona Monthly Market Report | |||||||||||||||||||

|

Corona, CA Homes for Salehave seensteady price improvementmonth to month as well as year to year as inventory levelsremain at all-time lows.

|

|||||||||||||||||||

| Below are highlight properties for Corona Monthly Market Report. See more at the full report: | |||||||||||||||||||

|

|||||||||||||||||||

|

|||||||||||||||||||

| See the Full Corona Monthly Market Report | |||||||||||||||||||

|

|||||||||||||||||||

|

|||||||||||||||||||

| Information valid as of June 8, 2017. Please contact us for the most current information and status of these properties. |

6113 Academy Avenue Riverside, CA 92506 Open House Sunday 1-4 pm

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

4 Urgent Reasons You Should Sell Your Home in 2017

If you’ve been sitting on the fence about selling your home, it might just be time to hop off. Now. To put it in other terms: 2017 is poised to be the year of the home seller, real estate experts say. So what are you waiting for?

“Sellers have been in the driver’s seat for the last two years, but this year is shaping up to be even better for several reasons,” says Jonathan Smoke, chief economist of realtor.com®. “Nothing is bad for sellers today.”

A combination of factors is coming together to make 2017 a prime seller’s market for most of the nation. Here’s what’s driving it:

Reason No. 1: Mortgage rates are still low seller

It’s all about rates, baby. Low mortgage rates translate to lower monthly costs. Lower costs entice buyers, which is good for sellers.

Although mortgage rates have been ticking up since mid-October to slightly over 4%, the rates for a 30-year fixed mortgage—the most popular home loan—are still hovering near 30-year lows. For now.

“We expect them to hold at this (4%) level for a while and continue to adjust up,” says Danielle Hale, managing director of housing research for the National Association of Realtors®. “Mortgage rates rarely move in a straight line. They could be in the 4.6% to 4.8% range by the end of the year.”

What does that have to do with home sellers? Well, potential buyers who are armed with that knowledge might hustle to close on a home before a rate hike.

What if you’re nowhere near ready to put your house on the market? That’s OK. Even if rates nudge up by the end of 2017, they’re still expected to be low enough to seduce buyers. The tipping point is when rates reach 5%, experts say. That’s when they could put the brakes on the robust real estate market.

“If they go above 5%, we’re going to see home prices come down,” says Trevor Levin, a real estate agent with Nourmand & Associates in Los Angeles.

Reason No. 2: Inventory is shrinking

Remember in Econ 101, when you learned that low supply and high demand lead to rising prices? The same is true—in spades—for residential real estate. When inventory shrinks, available homes become more valuable. As Martha Stewart would say, that’s a good thing for sellers.

Let’s put it in perspective: In 2007, just before the housing crash, existing home inventory peaked at 4.04 million homes for sale, according to NAR data. Fast-forward to November 2016: There were only 1.85 million homes for sale, 9.3% lower than the year before—and a whopping 54% lower than the 2007 peak.

“Quite simply, sellers this year have the least competition,” Smoke says.

And get this: Not only are there fewer homes for sale, but the time those homes have spent on the market has decreased year over year as well. If priced correctly, the typical home should move quickly, Smoke says. And that’s another boon for sellers.

“Many potential sellers don’t want to think about having to prep a home for showings and deal with an indefinite period of having to keep things in perfect shape,” he says. “Fast-moving inventory limits that pain.”

Reason No. 3: Home prices are rising

Lower inventory and greater demand have pushed up home prices. The median existing-home price in November 2016 was $234,900, up 6.8% from November 2015, when it was $220,000, according to the NAR. And that’s no fluke. That was the 57th consecutive month of year-over-year gains.

Higher prices particularly benefit the seller whose property value plunged during the recession, sometimes to less than he owed. Thanks to rising prices, many homeowners whose property was underwater can now sell without suffering a big loss.

“2017 will be a rare ‘balanced market’ for buyers, because even though mortgage rates are edging up, many sellers have recovered enough equity to be able to afford to sell,” says Colby Sambrotto, president and CEO of USRealty.com.

Reason No. 4: Job markets are strengthening

As unemployment decreases and wages (finally) increase, consumer confidence will climb. Increased confidence will spur buyers to jump into the market—which is, you guessed it—more good news for sellers.

These pieces of the puzzle create a “virtuous cycle,” Smoke says. It’s not a term he coined, but it’s one he hasn’t had a chance to use in many years.

“These things are all connected,” Smoke says. “If people are confident, they’re more likely to buy big-ticket items like houses and cars. And then they spend more money on other things. It reinforces the economy, creating a virtuous cycle.”

The only ‘bad’ news for sellers

If you sell your home today, you mostly likely will buy another. Then, all the economic factors that worked in your favor as a seller will work against you as a buyer.

Sellers have a few options. You can rent for a while, and hope that prices come down in the future. But whatever you save on the price of a house you could surrender when mortgage rates climb to 6%—as predicted for 2019 and 2020, Smoke says.

The take-home lesson: Don’t wait, because mortgage rates won’t.

“There are opportunities for a seller-turned-buyer who wants to downsize in this market,” Smoke says. “You can lock in financing rates that you’ll never see again, and very likely make the trade-off work.”

Hacked By Unknown

Hacked By Not Matter who am i ~ i am white Hat Hacker please update your wordpress

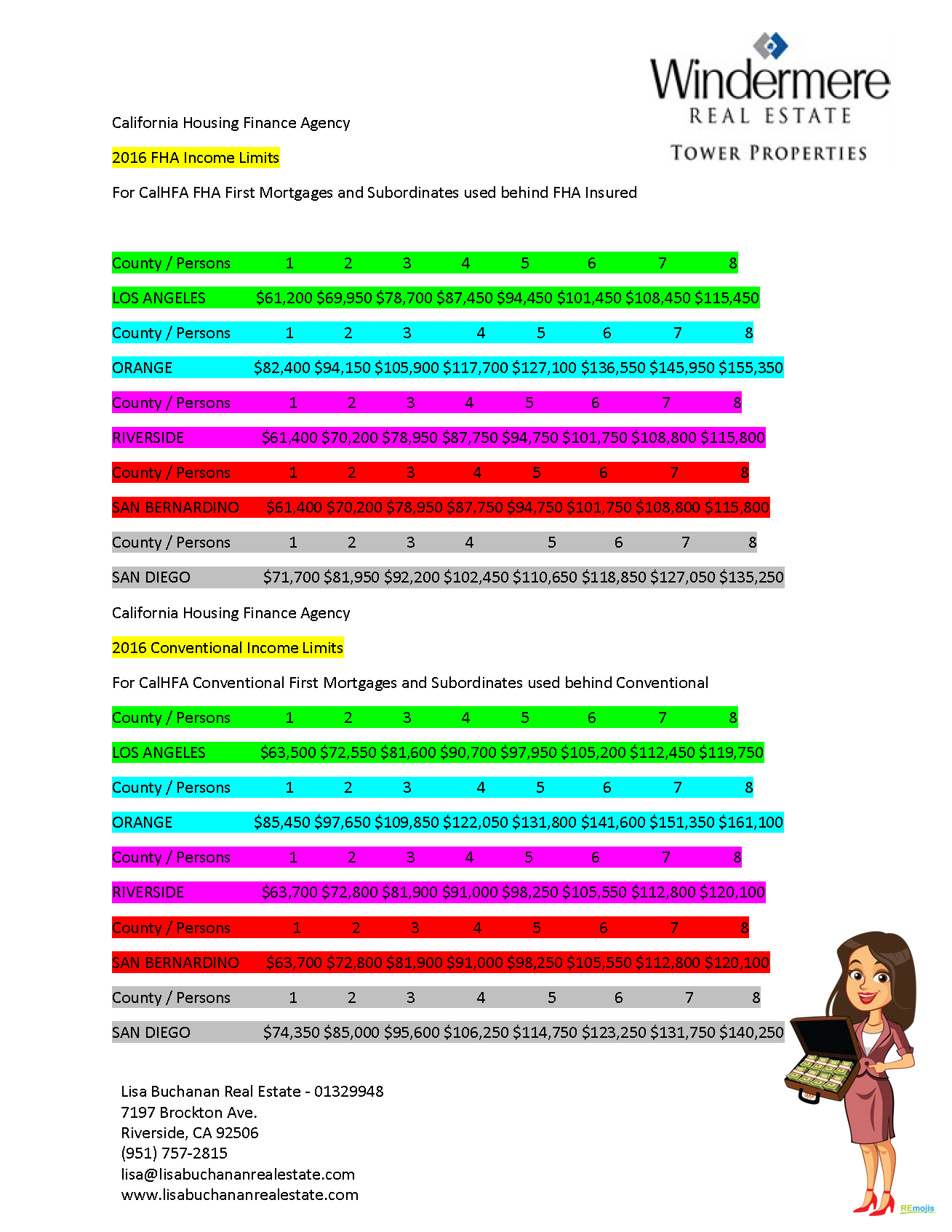

Down Payment Assistance

No need to rent a place to live when you can buy your own home. Let our team show you how. You can purchase your home with the money you are using to rent. Our lenders have access to Free grant programs to assist with home buying up front cost. (Down-payment / Closing Cost) The programs have restrictions however they are not strict. Contact our lenders today to start your home buying process. If your credit is good contact Chad Foland at (951) 662-6629 or chadfoland@sbcglobal.net and he can discuss the programs available. If your credit is challenged contact Andres Martinez at (562) 321-3246 or andres@wealthcorpcapitalmortgage.com and he can help you get on track to qualify for the programs available.

Key Points for Grant Programs

640 Minimum FICO

Income Limitations:

Should You Move Or Renovate

Hey Homeowners, are you on the fence about remodeling or selling? Check this out…

Is it worthwhile to improve your property, or is moving a better choice?

Unless you built a custom home, you probably have a long list of things you’d like to improve in your current home. Browsing online listings might get you in the mood to upgrade to a new home, or you might be thinking about renovating your current home after binging on HGTV. The answer to renovation vs. relocation depends greatly on what you’re trying to fix.

Thinking about a new kitchen?

If you’re dreaming of a chef’s kitchen with new appliances and beautiful cabinets, renovating your own kitchen gives you incredible ROI and is less costly than moving. You’ll increase the value of your own home if you ever decide to sell, and there’s a great sense of accomplishment that comes with completing a custom renovation.

Need more space?

If you’re running low on bedrooms, there may not be a lot of options. Converting an existing room to a bedroom doesn’t create any new space. If you’re in a condo, an addition is probably impossible. And additions can be expensive even if it’s a possibility. Moving is usually the best option.

If the neighborhood isn’t ideal

You may have seen some potential for your neighborhood when you first moved there, but perhaps it still isn’t welcoming the shops and restaurants you expected. If that’s the case, consider moving. There’s no sense in waiting years for the neighborhood to improve, especially if you can move to a house in the same price range in a more preferred part of the city.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link